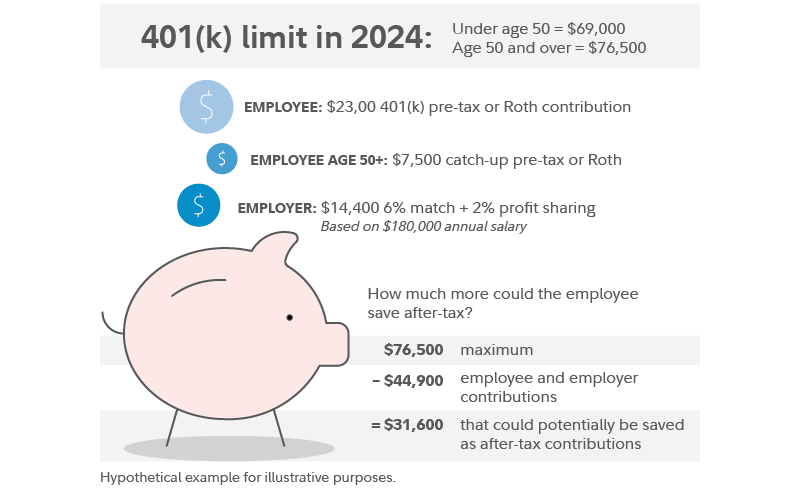

After Tax 401k Limit 2024 – Your personal contribution limit includes after-tax contributions to a designated Roth 401(k) account. Unlike a Roth IRA, designated-Roth contributions within a 401(k) are not subject to an income . A new year means a new opportunity to boost your retirement savings. Increasing contributions to your 401(k) or IRAs can get you there, but you should be aware of the limits. The IRS sets annual .

After Tax 401k Limit 2024

Source : thecollegeinvestor.comHere’s the Latest 401k, IRA and Other Contribution Limits for 2024

Source : theneighborhoodfinanceguy.com401(k) contribution limits 2023 and 2024 | Fidelity

Source : www.fidelity.com401(k) Contribution Limits in 2024 Meld Financial

Source : meldfinancial.comNew 2024 IRS Retirement Plan Contribution Limits [Including 401(k

Source : www.whitecoatinvestor.comContribution Limits Increase for Tax Year 2024 For Traditional

Source : directedira.comRoth IRA: Benefits, Rules, and Contribution Limits 2024

Source : districtcapitalmanagement.comAfter tax 401(k) contributions | Retirement benefits | Fidelity

Source : www.fidelity.comThe Ultimate Roth 401(k) Guide 2024

Source : districtcapitalmanagement.com2024 Contribution Limits Announced by the IRS

Source : www.advantaira.comAfter Tax 401k Limit 2024 401k Contribution Limits For 2024: The parameters of this government largesse change annually. For 2024, the IRS only allows you to save a total of $7,000 across all your traditional and Roth IRAs, combined. This figure is up from the . One of the biggest advantages of investing in a 401(k) or other employer-sponsored retirement account is that the money you contribute is tax deferred, which reduces the amount of your income that is .

]]>